Managing personal finances can often feel overwhelming, but it doesn't have to be. By applying straightforward strategies and using everyday tools, you can take control of your financial situation and work towards your financial goals. This guide will explore simple yet effective ways to manage your finances productively, ensuring that you have the right ingredients for financial success.

- Understanding the Basics of Personal Finance

Before diving into the hacks, it's essential to understand the fundamental components of personal finance:

- Budgeting: Creating a budget helps you track your income and expenses, allowing you to allocate funds effectively.

- Saving: Setting aside money for future needs or emergencies is crucial for financial stability.

- Investing: Growing your wealth through investments can help secure your financial future.

- Debt Management: Understanding how to manage and reduce debt is vital for maintaining good financial health.

1. Create a Simple Budget

A budget is the cornerstone of effective personal finance management. Here’s how to create one easily:

- Track Your Income: List all sources of income, including salary, side hustles, and passive income.

- List Your Expenses: Categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment).

- Set Goals: Determine what you want to achieve financially (saving for a vacation, paying off debt).

- Use Budgeting Tools: Leverage apps like Mint or YNAB (You Need A Budget) to simplify tracking.

Tip: Review your budget monthly and adjust as necessary to stay on track.

2. Automate Savings

One of the easiest ways to save money is through automation. Here’s how:

- Set Up Automatic Transfers: Schedule automatic transfers from your checking account to a savings account each payday.

- Use High-Interest Savings Accounts: Consider online banks that offer higher interest rates than traditional banks.

- Utilize Savings Apps: Apps like Acorns or Qapital can help you save spare change automatically.

3. Cut Unnecessary Expenses

Identifying and eliminating unnecessary expenses can free up more money for savings or investments. Consider these strategies:

- Review Subscriptions: Cancel unused subscriptions (streaming services, magazines) and memberships.

- Cook at Home: Reduce dining out by planning meals and cooking at home. This not only saves money but is often healthier.

- Shop Smart: Use coupons, shop sales, and compare prices before making purchases.

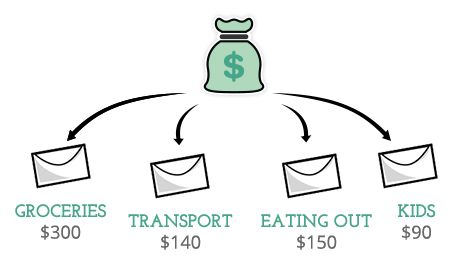

4. Use the Envelope System

The envelope system is a cash-based budgeting method that can help control spending:

- Create Envelopes for Categories: Allocate cash into envelopes labeled for specific spending categories (groceries, entertainment).

- Stick to the Cash Limit: Once the cash in an envelope is gone, avoid spending in that category until the next budgeting period.

5. Set Financial Goals

Setting clear financial goals can motivate you to stick to your budget and savings plan:

- SMART Goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Short-term vs Long-term Goals: Balance between immediate goals (saving for a vacation) and long-term objectives (retirement savings).

6. Educate Yourself on Personal Finance

Knowledge is power when it comes to managing finances effectively:

- Read Books and Blogs: Explore personal finance literature and blogs that provide valuable insights and tips.

- Attend Workshops/Webinars: Participate in local or online workshops focused on financial literacy.

7. Utilize Financial Tools

Take advantage of various tools designed to help manage finances effectively:

- Budgeting Apps: As mentioned earlier, apps like Mint or YNAB can simplify budgeting tasks.

- Investment Platforms: Use platforms like Robinhood or Betterment for easy access to investing without high fees.

8. Monitor Your Credit Score

Your credit score significantly impacts your financial health:

- Check Your Credit Report Regularly: Use services like AnnualCreditReport.com to access your credit report for free once a year.

- Understand What Affects Your Score: Factors include payment history, credit utilization, length of credit history, types of credit used, and recent inquiries.

9. Plan for Retirement Early

It’s never too early to start planning for retirement:

- Contribute to Retirement Accounts: If available, contribute to employer-sponsored 401(k) plans or open an IRA (Individual Retirement Account).

- Take Advantage of Employer Matches: If your employer offers matching contributions, ensure you contribute enough to get the full match.

10. Review Insurance Policies

Regularly reviewing your insurance policies can save you money:

- Compare Rates Annually: Shop around for better rates on auto, home, and health insurance.

- Adjust Coverage as Needed: Ensure you have adequate coverage without overpaying for unnecessary extras.

Conclusion

Managing personal finances doesn't have to be complicated. By implementing these easy hacks into your daily routine, you can take control of your financial future with confidence. Remember that consistency is key; regularly review your financial situation and adjust as necessary to stay on track towards achieving your goals.

Tags

#PersonalFinance #Budgeting #SavingMoney #FinancialLiteracy #MoneyManagement #Investing #DebtReduction #RetirementPlanning #FinancialGoals #SmartMoneyMoves